Whether or not you’re touring to Europe for 2 weeks or planning an epic round-the-world journey, you want journey insurance coverage.

Critically.

I do know, it’s not a enjoyable matter to examine. And sure, it can add to your journey finances. However after virtually 20 years on the street, I’ve discovered the laborious manner simply how essential journey insurance coverage might be.

I’ve had my baggage misplaced, I’ve popped an eardrum, and I’ve even been stabbed. Throw in numerous delayed and cancelled flights and I’d be out 1000’s upon 1000’s of {dollars}.

Thankfully, I had journey insurance coverage. They have been there to assist me navigate the issues and guarantee I didn’t go broke paying for emergency bills.

As of late, SafetyWing is my go-to journey insurance coverage firm. I’ve been utilizing them for years and have discovered their plans to be tremendous inexpensive, their customer support quick and pleasant, and their protection to be adequate for what I want.

At the moment, SafetyWing presents two plans for vacationers:

- Nomad Insurance coverage Important

- Nomad Insurance coverage Full

Whereas each plans are nice, they’re every designed for particular sorts of vacationers. On this publish, I’ll break down what every plan covers and who it’s for therefore you may resolve which plan is greatest on your subsequent journey.

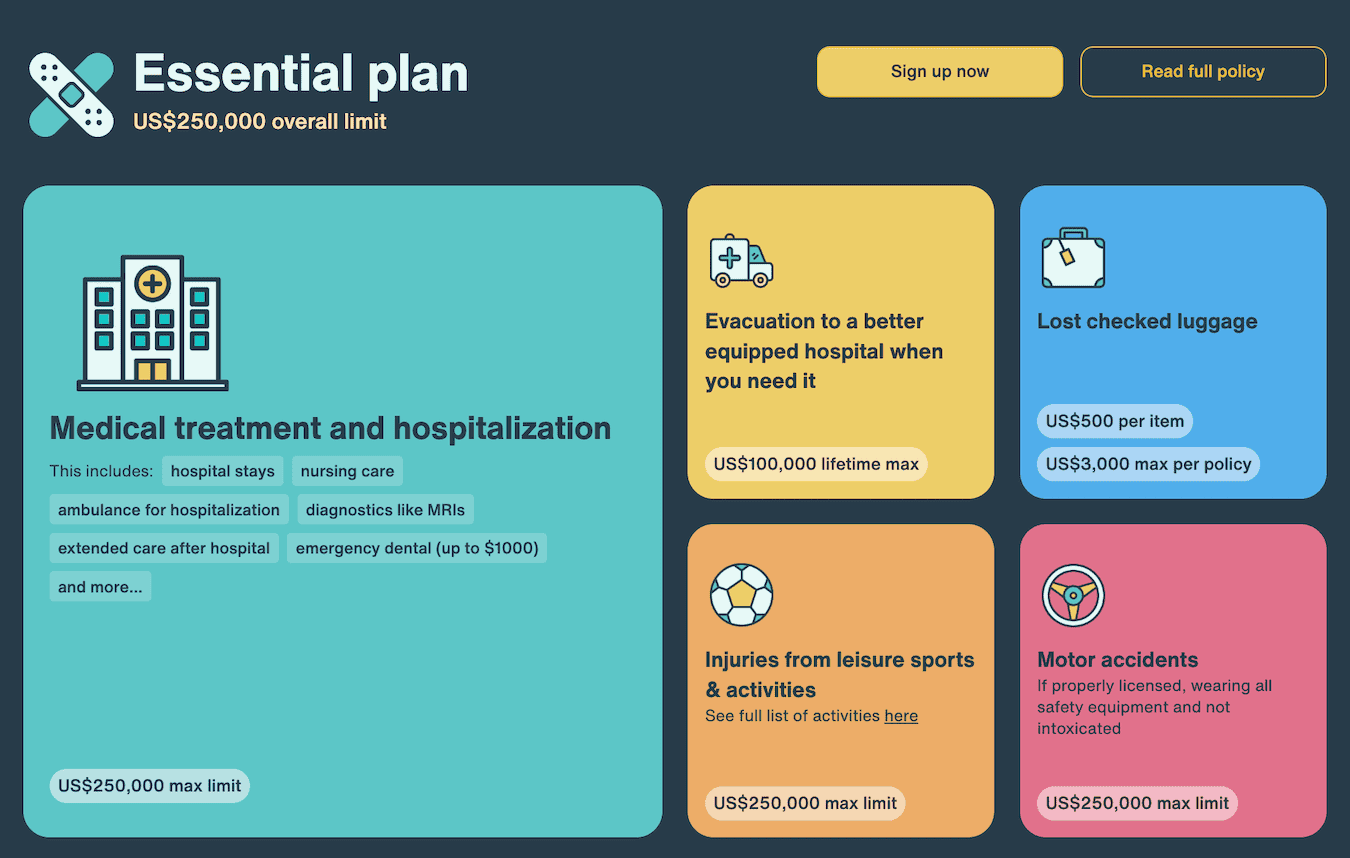

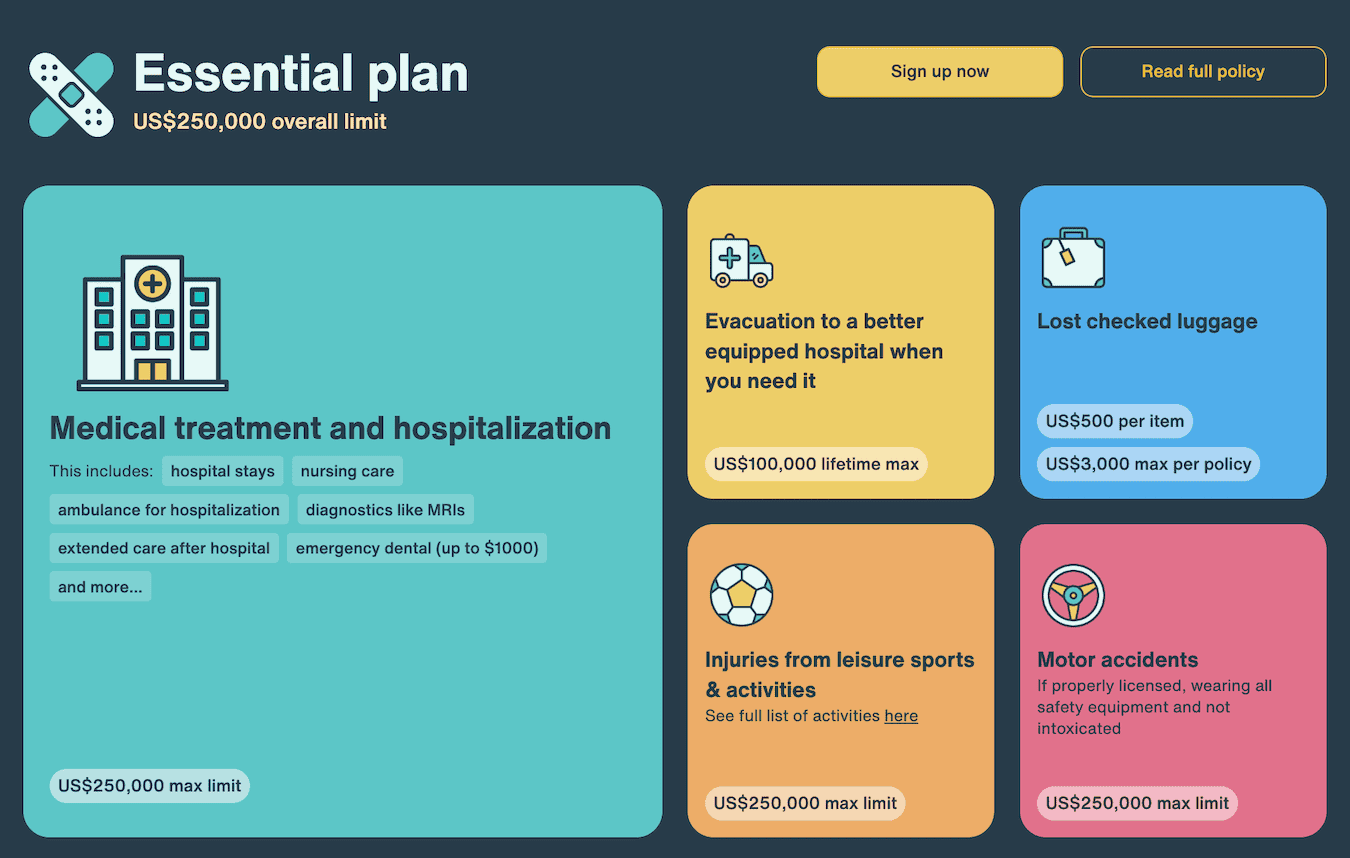

The SafetyWing Important Plan

That is the primary journey insurance coverage plan from SafetyWing. It’s designed for vacationers who need primary protection with out breaking the financial institution. It’s the plan I exploit once I journey lately.

The plan prices simply $56.28 USD for 4 weeks (for vacationers aged 10-39). That’s one of many lowest costs on the market for dependable journey insurance coverage. They’re tremendous aggressive on the subject of worth.

For comparability, related plans from different corporations are double that (or extra). The plan is appropriate for vacationers as much as age 69, although vacationers 60–69 can be paying $196.84.

Here’s what the Important plan covers at a look:

- $250,000 for emergency medical therapy and hospitalization

- $100,000 for medical evacuation

- $250,000 for motor accidents

- As much as $3,000 for misplaced baggage ($500 per merchandise)

- $10,000 for evacuation resulting from political unrest

- $5,000 for journey interruption

- $200 for journey delay ($100 per day for 2 days)

In addition they have three useful add-ons:

- Protection for journey sports activities

- Protection when you’re visiting the US

- Protection for electronics theft

Since not everybody wants these, I like that they’re out there as add-ons. Personally, I all the time want further electronics protection, however I by no means want protection for journey sports activities since I’m just about the other of an adrenaline junkie. I like that I can customise the plan to swimsuit my journey plans/journey model.

Who’s the important Plan For?

SafetyWing’s major plan is nice for a variety of vacationers. Listed here are the sorts of vacationers that I feel the coverage is greatest for:

Backpackers – I feel the Important’s plan is one of the best journey insurance coverage plan for vacationers on a finances. It’s what I exploit once I journey lately as a result of it balances affordability with protection. At only a couple bucks per day it gained’t break the financial institution and it has protection for all essentially the most severe potential emergencies.

Finances & Midrange Vacationers – In the event you’re touring to Europe for just a few weeks or heading to the Caribbean for a calming vacation, this plan is for you. It balances value with emergency protection, in addition to some protection for issues like delays and cancellations.

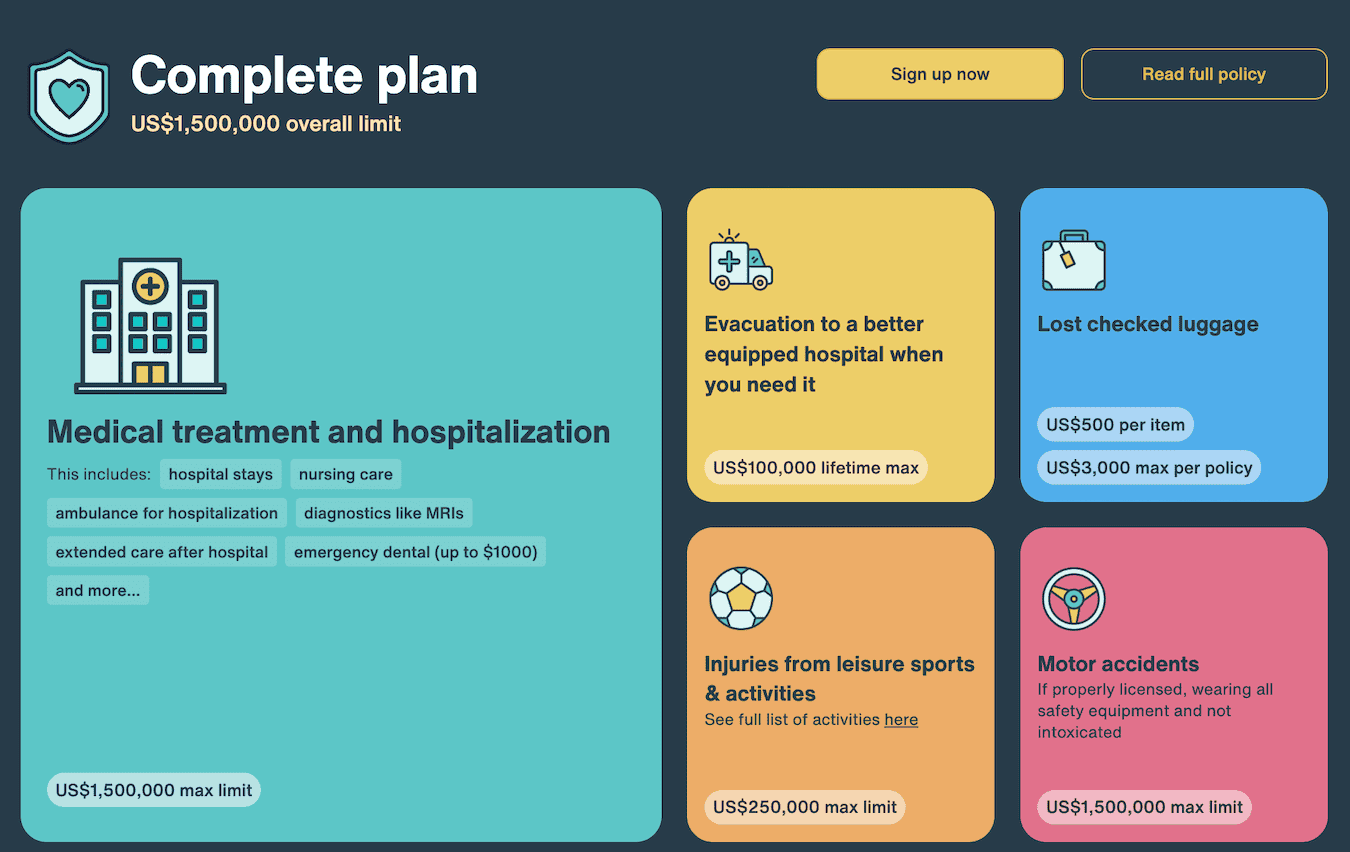

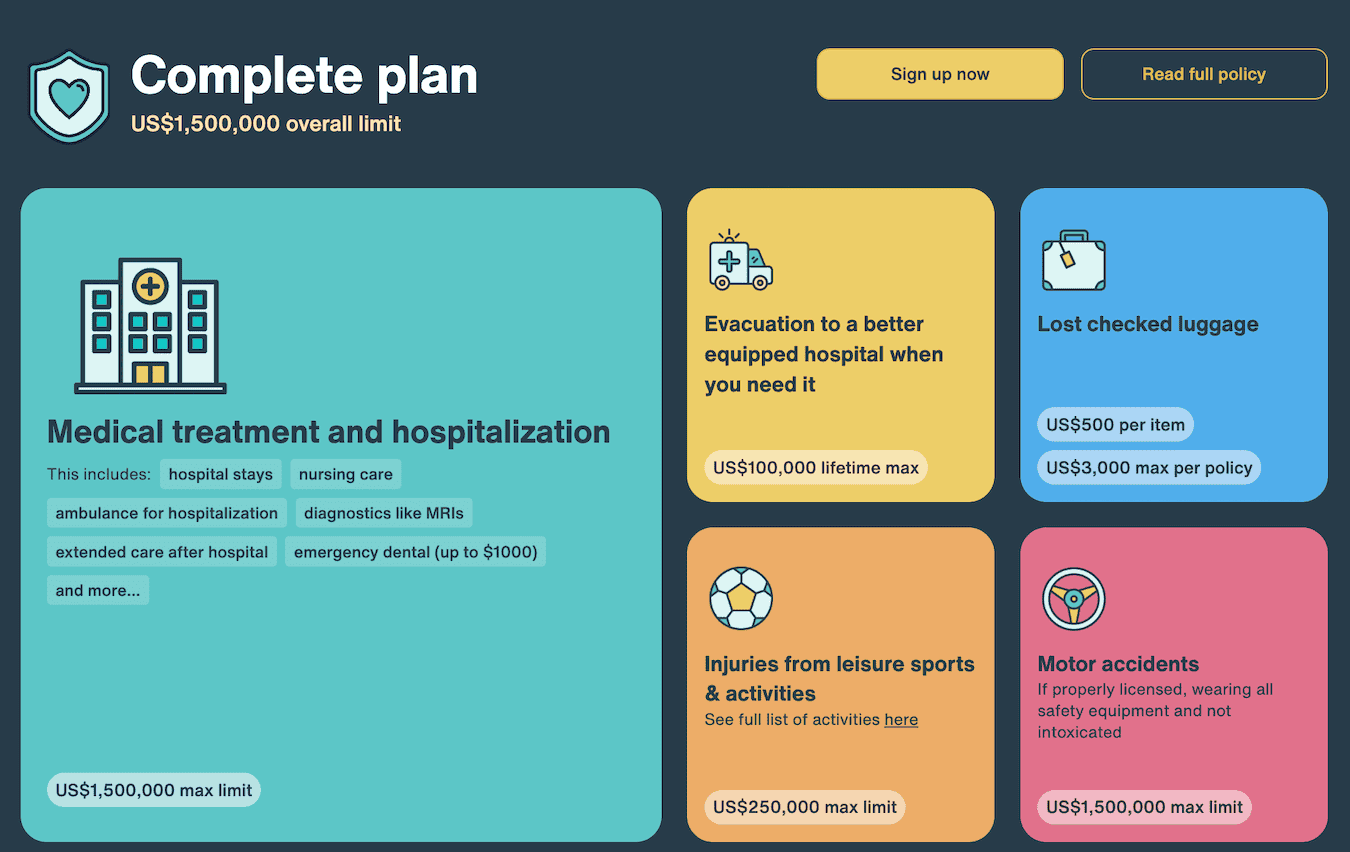

The SafetyWing Full Plan

The Full plan is insurance coverage for digital nomads, distant staff, and long-term vacationers. It’s a mixture of your commonplace emergency protection (just like the Important plan above) nevertheless it additionally contains “common” non-emergency protection.

So, not solely does the plan cowl issues like emergency accidents and sickness nevertheless it additionally contains routine visits and preventive care. It’s a duplicate of the sort of medical insurance you would possibly discover in your house nation, making certain that you simply’re taken care of it doesn’t matter what occurs.

The plan prices $150.50 for 4 weeks (for vacationers aged 18–39). It’s out there to vacationers as much as age 64.

Right here’s a take a look at what the plan covers for emergencies:

- $1,500,000 in protection for medical emergencies

- $100,000 for medical evacuation

- $1,500,000 for motor accidents

- As much as $3,000 for misplaced baggage ($500 per merchandise)

- $10,000 for evacuation resulting from political unrest

- $5,000 for journey interruption

- 150 per day for journey delay (as much as three days), $60 for delays over three hours

- $100,000 for unintentional demise

General, the emergency protection of this plan is just like the Important plan, however expanded and with larger limits.

Right here’s a take a look at the plan’s extra “commonplace healthcare” protection:

- $5,000 for physician visits (dermatologist, gynecologist, and many others.)

- $300 for routine check-ups

- 10 psychologist or psychiatrist visits per 12 months

- $1,500,000 for most cancers therapy

- $2,500 for maternity care

- $5,000 for wellness therapy

- $5,000 for stolen belongings

As you may see, the Full plan is rather more sturdy than the Important plan. It’s the plan I want I had once I first began backpacking full-time as a result of it’s simply so complete. If I used to be working remotely abroad full time, that is the plan I might use.

Moreover, new situations akin to diabetes or bronchial asthma are coated beneath the Full plan (beneath Important, they turn out to be pre-existing situations). That’s one thing not a whole lot of different corporations supply, which I feel is a big plus.

One essential distinction between the Full and Important plans, nonetheless, is that, in contrast to common journey insurance coverage, Nomad Insurance coverage Full candidates have to be permitted. You possibly can’t simply purchase a plan and be in your merry manner, because the insurance coverage group must overview your software, together with any medical historical past and/or pre-existing situations. They could additionally request extra medical notes or paperwork.

Whereas I don’t love that some persons are prone to be screened out and you may simply purchase a plan with a click on and be in your manner, I perceive the reasoning given the price of well being care all over the world.

Who’s the Full Plan For?

SafetyWing’s Full plan is ideal for 3 sorts of vacationers:

Lengthy-Time period Vacationers – In the event you’re planning to journey for a 12 months or extra, that is the plan for you. It would guarantee you may have protection for emergencies, in addition to for routine check-ups. And the upper protection limits for delays and cancellations are a should for these touring usually.

Digital Nomads – In the event you’re going to be touring and dealing, you’re going to need emergency protection with a excessive restrict. The wellness protection the Full plan contains can also be a pleasant contact.

Expats – In the event you’re residing overseas for some (or all) of the 12 months, you’ll wish to have entry to each emergency protection in addition to common check-ups. The evacuation protection is a should too must you be residing in additional turbulent areas.

I by no means go away house with out journey insurance coverage. For just some {dollars} a day, you not solely make sure you don’t go bankrupt ought to an emergency happen, however you’ll additionally get peace of thoughts understanding that you’ve got assist and help ought to one thing occur.

Whether or not you’re a finances backpacker in search of a primary plan or a seasoned digital nomad who wants sturdy healthcare, SafetyWing has you coated.

Use the widget under to get a free quote:

E-book Your Journey: Logistical Suggestions and Methods

E-book Your Flight

Discover a low-cost flight through the use of Skyscanner. It’s my favourite search engine as a result of it searches web sites and airways across the globe so that you all the time know no stone is being left unturned.

E-book Your Lodging

You possibly can guide your hostel with Hostelworld. If you wish to keep someplace aside from a hostel, use Reserving.com because it persistently returns the most affordable charges for guesthouses and inns.

Don’t Overlook Journey Insurance coverage

Journey insurance coverage will defend you in opposition to sickness, damage, theft, and cancellations. It’s complete safety in case something goes improper. I by no means go on a visit with out it as I’ve had to make use of it many instances up to now. My favourite corporations that supply one of the best service and worth are:

Wish to Journey for Free?

Journey bank cards help you earn factors that may be redeemed without spending a dime flights and lodging — all with none further spending. Take a look at my information to choosing the right card and my present favorites to get began and see the newest greatest offers.

Want Assist Discovering Actions for Your Journey?

Get Your Information is a big on-line market the place you will discover cool strolling excursions, enjoyable excursions, skip-the-line tickets, non-public guides, and extra.

Able to E-book Your Journey?

Take a look at my useful resource web page for one of the best corporations to make use of if you journey. I listing all those I exploit once I journey. They’re one of the best at school and you may’t go improper utilizing them in your journey.