On this version of Head-to-Head, we’re evaluating two Canadian bank cards catering to several types of spenders: the Neo World Elite® Mastercard and the Scotia Momentum® Visa Infinite* Card.

Whereas each provide spectacular money again earnings, they cater to several types of spenders.

Let’s break down which one offers you one of the best general worth.

Neo World Elite® Mastercard vs. Scotia Momentum® Visa Infinite*

Card Fundamentals

When taking a look at completely different bank cards, you’ll need to first concentrate on the fundamentals. Check out what sign-up presents they’ve, how a lot they value every year, and what rewards you may earn on purchases. This can assist you determine which card offers you one of the best general worth.

1. Welcome Bonuses

The Scotia Momentum® Visa Infinite* offers new cardholders 10% money again on the primary $2,000 in purchases inside three months, a stable incentive to begin incomes straight away.

In the meantime, the Neo World Elite® Mastercard doesn’t provide a conventional welcome bonus however supplies a barely larger default money again in grocery purchases and the means to earn boosted money again (which we are going to discuss later intimately).

Verdict: Whereas Neo’s system may be profitable, the dearth of an upfront bonus is a downside. The assured 10% money again provided by Scotia Momentum® Visa Infinite* card is hard to beat.

2. Annual Charges

The Neo World Elite® Mastercard prices $125 per yr, whereas the Scotia Momentum® Visa Infinite* is available in barely decrease at $120 per yr, typically with a first-year charge waiver. Should you’re in search of a decrease upfront value, the first-year free provide makes a viable distinction.

Nonetheless, Neo’s money again construction could enable cardholders to offset the annual charge extra rapidly in comparison with Scotia Momentum® Visa Infinite* card’s fastened money again mannequin. Frequent grocery and gasoline buyers who maximize Neo’s incomes potential could discover the $125 charge justified.

Verdict: Scotia Momentum® Visa Infinite* Card wins this class with a barely decrease charge and frequent first-year annual charge waiver presents.

3. Incomes Charges

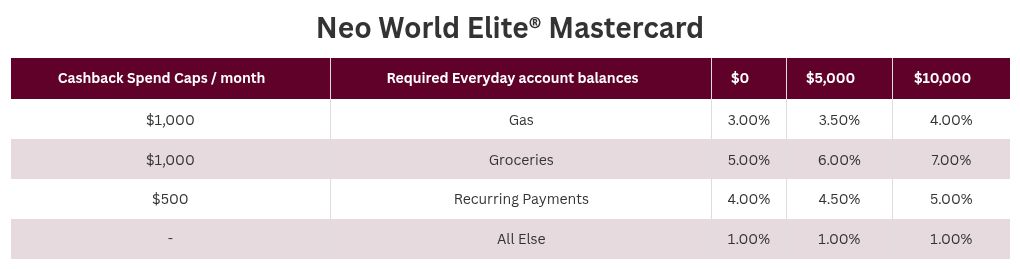

The Neo World Elite® Mastercard presents a extremely aggressive money again construction, beginning at 5% on groceries, 4% on recurring payments, and three% on gasoline. These base charges already match or outperform these of the Scotia Momentum® Visa Infinite Card*, which supplies 4% on groceries and recurring payments, 2% on gasoline and transit, and 1% on every part else.

The place Neo units itself aside is the power to spice up these base charges even additional. Cardholders with no less than $5,000 in a Neo On a regular basis Account obtain a barely larger money again charge, whereas these with $10,000 or extra unlock the utmost incomes potential of 7% on groceries, 5% on recurring payments, and 4% on gasoline.

This permits frequent spenders to extract much more worth from their purchases.

Verdict: Should you’re in search of the absolute best money again charges and are prepared to optimize your spending, the Neo World Elite® Mastercard is the superior alternative. Nonetheless, in case you favor a flat-rate system with no further monitoring or necessities, Scotiabank’s mannequin could also be preferable.

4. Ease of Redeeming

Neo World Elite® Mastercard money again is credited immediately at taking part retailers, whereas Scotia Momentum® Visa Infinite* awards money again as soon as per yr in November. Should you favor getting rewards all year long moderately than ready, Neo has a transparent benefit.

Scotia Momentum® Visa Infinite* card’s annual payout, nevertheless, can function a pressured financial savings mechanism, offering a lump sum money again on the finish of the yr that can be utilized for journey, vacation spending, or investments.

Verdict: Neo World Elite® Mastercard wins this class for the reason that means to immediately declare money again beats ready till year-end unquestionably.

5. International Transaction Charges

The Scotia Momentum® Visa Infinite* card prices a normal 2.5% overseas transaction charge, whereas the Neo World Elite® Mastercard prices 3%.

Verdict: Whereas the Scotia Momentum® Visa Infinite* card has a slight edge with its 2.5% charge versus Neo Monetary’s 3%, neither is good since there are playing cards with no overseas transaction charges. You probably have important abroad spending or often store on-line in foreign exchange, it’s higher to look into devoted no-foreign-transaction-fee choices.

Perks and Advantages

Since each playing cards are money again bank cards, they’re each closely targeted on money again incomes charges and classes moderately than recurring perks and advantages.

Scotia Momentum® Visa Infinite* supplies Visa Infinite perks, together with concierge service, unique resort reductions, and premium occasion entry.

Visa Infinite Perks

As a Visa Infinite card, the Scotia Momentum® Visa Infinite Card* supplies cardholders with unique advantages, together with:

- Visa Infinite Concierge service for journey and way of life wants

- Entry to luxurious resort perks and eating experiences

- Premium occasion entry with unique ticket presents

In the meantime, Neo World Elite® Mastercard consists of World Elite advantages, corresponding to reductions on Cirque du Soleil, concierge providers, and prolonged guarantee safety.

World Elite Perks

The Neo World Elite® Mastercard presents World Elite Mastercard advantages corresponding to:

- Mastercard Concierge service for journey and leisure

- Unique reductions on Cirque du Soleil reveals

- Mastercard Journey Go supplied by DragonPass

- Prolonged guarantee and buy safety for added safety

Different Components

1. Ease of Getting Accredited

Each playing cards require a minimal revenue threshold to qualify. The Scotia Momentum® Visa Infinite* card requires $60,000 private or $100,000 family revenue, whereas the NEO World Elite® Mastercard requires $80,000 private or $150,000 family revenue.

On prime of the revenue requirement, you’ll additionally want a reasonably good credit score rating to be accredited. Nonetheless, what makes the NEO World Elite® Mastercard distinctive is that even when your credit score rating doesn’t meet the approval requirement, you’ll be accredited for the secured credit score model of the cardboard, which shares the very same incomes charges and advantages.

This generally is a large profit for newcomers who may not but have a superb credit score rating, or somebody who’s financially steady now however the credit score rating is taking a while to recuperate.

Verdict: Neo World Elite® Mastercard is the clear winner as it might approve anybody who meets the revenue requirement, whether or not the common bank card or the secured credit score model of card.

2. Supplementary Playing cards

The Scotia Momentum® Visa Infinite* card permits further cardholders for $50 per yr, whereas the Neo World Elite® Mastercard at present doesn’t provide supplementary playing cards.

Verdict: Scotia Momentum® Visa Infinite* wins this class for the reason that means to share advantages with further customers is a bonus.

3. Insurance coverage Protection

When evaluating the Neo World Elite® Mastercard and the Scotia Momentum® Visa Infinite*, the most important variations lie in emergency medical and journey insurance coverage.

For emergency medical protection, the Scotia Momentum® Visa Infinite* presents as much as $1 million for 15 days, masking travellers underneath 65, whereas Neo supplies $1 million for 14 days, however just for these underneath 60.

In journey cancellation and interruption insurance coverage, Scotia Momentum® Visa Infinite* card once more has the sting, masking as much as $1,500 per individual for cancellations and $2,000 per individual for interruptions, in comparison with Neo’s $1,000 per individual for each.

For flight delays, Scotia Momentum® Visa Infinite* supplies $500 per individual after a 4-hour delay, whereas Neo caps at $500 per journey whole, which means a number of travellers should share the profit.

On the acquisition safety facet, Neo has a $1,000 per-item restrict, barely higher than Scotia Momentum® Visa Infinite* card’s unspecified restrict, however each provide 90-day safety and one-year prolonged guarantee.

Lastly, resort housebreaking insurance coverage is unique to Neo, masking as much as $1,000 for stolen private objects, whereas Scotia supplies no protection on this class.

Verdict: Scotia Momentum® Visa Infinite* is the higher alternative for emergency medical, journey insurance coverage, and flight delay advantages, whereas Neo World® Elite Mastercard is stronger in baggage safety, housebreaking protection, and buy safety.

4. Visible Look

The Neo World Elite® Mastercard incorporates a glossy, trendy black end design with a vertical structure, whereas the Scotia Momentum® Visa Infinite* has a conventional horizontal format with a premium look.

Whereas there aren’t any distinction in performance as a bank card in relation to paying at terminal, the Neo card does

Verdict: Whereas this measure is solely subjective, the Neo World Elite® Mastercard’s black end and vertical structure makes it extra interesting than the Scotia Momentum® Visa Infinite*.

Conclusion

Each playing cards provide distinct benefits relying in your spending habits and preferences.

The Neo World Elite® Mastercard delivers spectacular money again potential with the additional advantage of instantaneous redemptions that put a reimbursement in your pocket instantly moderately than yearly.

The Scotia Momentum® Visa Infinite* Card supplies a robust welcome bonus, much less upfront value, and the power so as to add supplementary playing cards for relations—a function Neo at present doesn’t provide.

The place Neo good points an edge is in its versatile approval course of, trendy method to rewards, and potential for larger general returns when strategically utilized. Its tiered incomes construction rewards loyalty whereas offering quick advantages.

Your optimum alternative finally depends upon your private spending patterns, however Neo’s forward-looking rewards construction positions it nicely for in the present day’s savvy shopper.