Welcome again to our collection on the way to leverage bank card multipliers to maximise your incomes potential. In Half 1, we centered on playing cards issued by American Specific.

American Specific is a good financial institution to build up factors with due to its huge array of switch companions obtainable via American Specific Membership Rewards. It additionally has co-branded playing cards with Air Canada, making it straightforward to build up Aeroplan factors, a serious participant in our Canadian panorama.

Sadly, not all retailers settle for Amex, on condition that it tends to levy larger service provider processing charges. Undoubtedly there’ll be occasions you’ll have to drag out a Mastercard or Visa, so in Half 2 of this collection, we’ll now have a look at class incomes multipliers on playing cards issued by different banks.

For simplicity’s sake, we’ll solely concentrate on Canadian playing cards that earn airline factors currencies or their equal, versus money again playing cards or different fixed-value factors currencies.

Canadian Banks with Airline Companions

American Specific has probably the most flexibility on the subject of switch companions, with a complete of six airline companions and two lodge companions. Nonetheless, there are nonetheless some good Visa and Mastercard choices.

In Canada, RBC, CIBC, TD, Brim Monetary, and Neo Monetary all have bank cards with which you’ll earn airline factors.

RBC

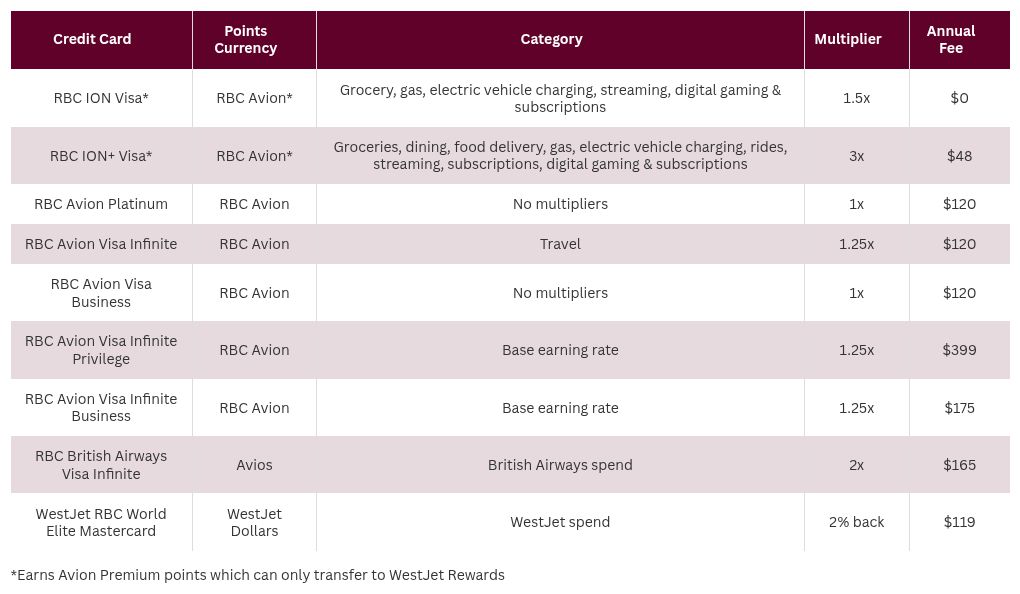

RBC presents a few bank cards that may earn airline currencies immediately:

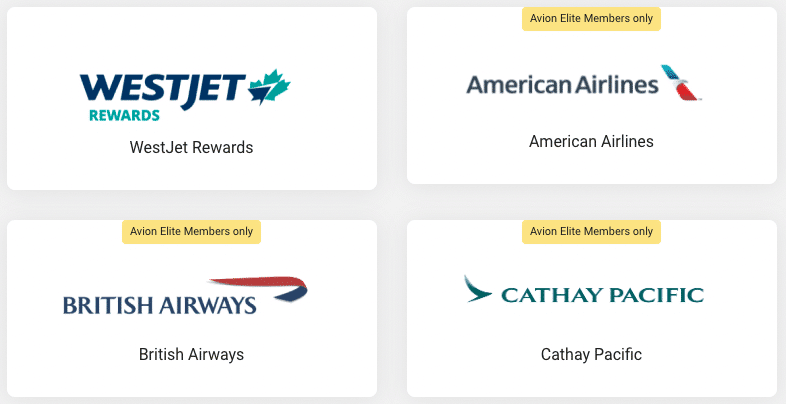

RBC additionally has its personal line of Avion bank cards that earn RBC Avion factors. There are two tier of Avion factors: Avion Premium factors and Avion Elite factors.

The ION household of playing cards earns Avion Premium factors that are extra restrictive and might solely be transferred on to WestJet Rewards. All different Avion-branded playing cards earn Avion Elite factors, which may be transferred to 4 airline companions.

The switch ratios from RBC Avion to the airline currencies are as follows:

Retaining these companions and ratios in thoughts, let’s have a look at what the bank card multipliers are, if any:

The ION household of playing cards takes the prize for greatest earn charges, however for higher flexibility in reward redemption, you’ll need a card that earns Avion Elite factors just like the RBC Avion Visa Infinite card.

For a better base incomes charge of 1.25 factors per greenback spent, seize a premium card, however ensure you’ll be able to justify the upper annual price (maybe by redeeming for enterprise class flights at 2 cents per level).

TD and CIBC

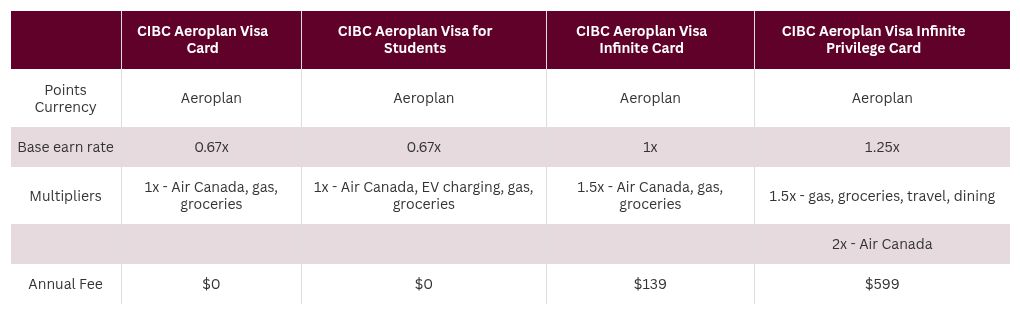

I’ve grouped TD and CIBC collectively as a result of they each solely have one airline program accomplice, Aeroplan, though take into account that any Aeroplan factors earned may be redeemed on any considered one of Aeroplan’s many airline companions.

Each banks supply a number of totally different tiered Visa playing cards that may earn Aeroplan factors immediately:

Now let’s check out how their incomes charges evaluate:

Be aware that for the TD playing cards with a Starbucks multiplier, it’s essential to hyperlink your TD bank card to your Starbucks account to earn the multiplier.

The earn charges between totally different tiers of TD and CIBC playing cards are somewhat related, so when deciding between a TD or CIBC card, it might come right down to different components resembling welcome bonuses and different bank card advantages.

In the event you’re on the lookout for a no-fee entry-level keeper card, then the CIBC Aeroplan Visa Card is an efficient choice in comparison with the TD Aeroplan Visa Platinum Card, which fees an $89 annual price.

Understand that TD and CIBC typically supply a primary 12 months free profit on their Visa Infinite playing cards, so with the upper earn charge, it’s possible you’ll be higher off selecting considered one of these playing cards for not less than the primary 12 months.

Brim Monetary

In 2022, Brim Monetary launched Canada’s first and solely Air France-KLM Flying Blue co-branded bank card, the Air France-KLM World Elite Mastercard.

The cardboard has the next earn charges:

- 1 Flying Blue mile per greenback base earn charge

- 2 Flying Blue miles per greenback spent on eating places and bars

Once you evaluate incomes strategies for Flying Blue miles, the Air France-KLM World Elite Mastercard can come out forward of transferring from American Specific. Whereas Amex lets you convert Membership Rewards factors to Flying Blue miles at a 1:0.7 ratio, the direct incomes from the Air France-KLM card can show extra advantageous even with its modest incomes charges. The annual price of $132 can also be on par with different mid-tier playing cards.

Periodically, Brim presents boosted earn charges when purchasing with choose accomplice retailers.

Neo Monetary

After RBC discontinued its Cathay Pacific Visa Platinum card and the HSBC World Elite Mastercard was phased out following RBC’s acquisition of HSBC in 2023, Neo Monetary stepped in to fill the hole. Although not broadly recognized amongst Canadians, Neo Monetary now presents Canada’s sole Asia Miles co-branded bank card, the Cathay World Elite® Mastercard.

The cardboard takes a simple method to rewards; as an alternative of providing numerous class multipliers, it differentiates between purchases made in Canadian {dollars} and people made in foreign exchange, encouraging its use when overseas.

The cardboard has the next earn charges:

- 1 Asia Mile per greenback spent on purchases made in Canadian {dollars}

- 2 Asia Miles per greenback spent on purchases made in foreign exchange

- 2 Asia Miles per greenback spent on Cathay Pacific flights

Although the earn charge is fairly commonplace for purchases made in Canadian {dollars}, the elevated earn charge on purchases made overseas helps offset the overseas transaction price. You’ll additionally must issue within the $180 annual price which is on the upper finish.

Like Brim, Neo additionally presents elevated incomes charges with its retail companions.

Which Non-Amex Credit score Card Ought to You Use?

To find out which card will greatest maximize your earn, you’ll must do a private evaluation to see what your spending and journey patterns are.

Your spending patterns will decide which multipliers pertain probably the most to you. Your journey patterns will decide which airline program you’ll wish to spend money on, what number of factors it’s possible you’ll want, and whether or not you’ll be able to justify the upper annual price of a card in change for the opposite advantages which will include it.

If amassing Aeroplan factors is your purpose, the one non-Amex choices are a TD or CIBC Aeroplan Visa card. Which tier of card you select will depend upon what you spend probably the most on, whether or not your spend can justify the annual price, and the welcome bonus on the time.

In the event you can justify the annual price of an Infinite Privilege card, you’ll maximize your earn with 1.25x as a base incomes charge and 1.5x on most main classes of spending.

In the event you’re planning to fly on an airline that’s a part of the Oneworld alliance, then think about your spending patterns.

For normal spending, it’s a detailed race between the RBC® Avion Visa Infinite Privilege card or RBC Avion Visa Enterprise card, which earn 1.25 Avios or Asia Miles per greenback spent. The Cathay World Elite® Mastercard is one other strong contender, because it earns a minimal of 1 Asia Mile per greenback spent, and is among the few playing cards that provide a multiplier on spend in foreign exchange.

In the event you discover worth within the American Airways AAdvantage program (ie. reserving Qatar Airways’ Qsuites with the bottom taxes and charges), then RBC Avion-earning playing cards can be the popular selection.

For households who journey to Europe usually, then Air France-KLM Flying Blue’s 25% off low cost on award tickets for kids will possible enchantment to you, and it’s possible you’ll discover higher worth utilizing the Air France-KLM World Elite Mastercard in your each day spend.

In the event you’re taking a look at a better base incomes charge, then you definitely’ll wish to have a look at the Visa Infinite Privilege playing cards, which all earn 1.25 factors per greenback spent as a base incomes charge, and 1.5 factors per greenback spent on eating.

The upper incomes charges alone, nevertheless, could not justify the excessive annual price of $599, until you’ll be able to make the most of the opposite advantages that include the cardboard.

In the event you’re a Starbucks fan, then you definitely’ll most likely wish to look right into a TD card somewhat than CIBC, as they provide a 50% bonus if you happen to hyperlink any TD Aeroplan card to your Starbucks account.

And at last, holding each a Visa and a Mastercard in your pockets can also be a great technique as not all retailers will settle for each.

Conclusion

Sadly, there are nonetheless many retailers that don’t take American Specific, however that doesn’t imply you must cease incomes airline factors.

RBC, TD, CIBC, Brim Monetary, and Neo Monetary are all banks that provide Credit cards and Visas that may, in some instances, supply higher incomes charges on airline currencies than American Specific.

Take a while to investigate your individual spend and journey patterns and see which card or playing cards will allow you to obtain your journey objectives sooner.