Scotiabank has formally launched the Scotiabank Passport® Visa Infinite Privilege* Card, a premium journey bank card designed for high-spending travellers who desire a mixture of robust incomes charges, elevated perks, and no international transaction charges.

With a juicy welcome bonus, 10 complimentary airport lounge visits, and an annual journey credit score, this card is positioned as top-of-the-line premium fixed-value journey bank cards in Canada.

Let’s take a better have a look at this card, and see what number of options it boasts to assist justify its $599 annual payment.

Welcome Bonus & Annual Price

As an introductory welcome bonus, the Scotiabank Passport® Visa Infinite Privilege* Card is providing as much as 80,000 Scene+ factors, awarded in three phases:

- 30,000 Scene+ factors after spending $3,000 within the first three months.

- 30,000 Scene+ factors after spending $20,000 within the first six months.

- 20,000 Scene+ factors after making no less than one buy within the 14th month after account opening.

Since Scene+ factors have a hard and fast worth of 1 cent per level, this welcome bonus alone is value as much as $800.

The annual payment for the cardboard is $599, and supplementary playing cards price $199 per 12 months. Nonetheless, Scotiabank presents a $150 rebate on the annual payment for many who maintain a Scotiabank Final Package deal banking account.

Whereas $800 in journey worth sounds spectacular, it’s essential to notice that maximizing the total bonus requires $20,000 in spending throughout the first six months — which isn’t possible for everybody.

Scotiabank Passport® Visa Infinite Privilege* Card

- Earn 30,000 Scene+ factors upon spending $3,000 within the first three months

- Plus, earn an extra 30,000 Scene+ factors upon spending $20,000 within the first six months

- And, earn an extra 20,000 Scene+ factors while you make no less than one eligible buy throughout the 14th month of account opening

- Earn 3x Scene+ factors on eligible journey purchases

- Earn 2x Scene+ factors on eating and leisure purchases

- Visa Airport Companion membership with 10 free lounge visits per 12 months

- $250 annual journey credit score

- Redeem factors for an announcement credit score in opposition to any journey expense

- Minimal revenue: $150,000 private or $200,000 family

- Annual payment: $599

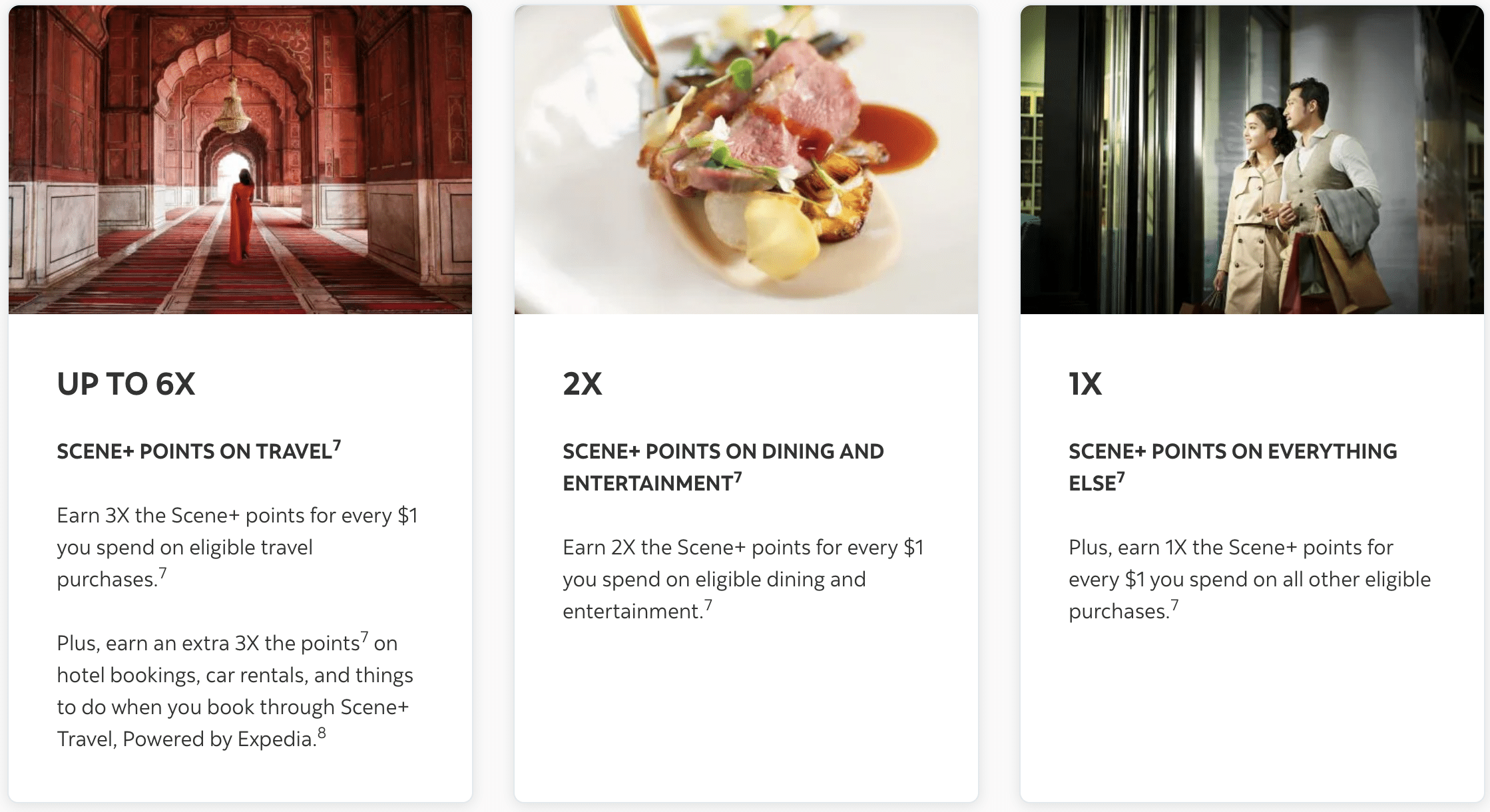

Incomes Charges on On a regular basis Spending

The Scotiabank Passport® Visa Infinite Privilege* Card presents presents strong incomes charges for journey purchases, however there are additionally some noticeable gaps that make it much less aggressive than anticipated for on a regular basis spending.

Right here’s the way you’ll earn Scene+ factors on on a regular basis spending:

- 3 Scene+ factors per greenback spent on all eligible journey purchases, similar to flights, lodges, automobile leases, trains, and cruises

- 2 Scene+ factors per greenback spent on eating and leisure, making it a strong card for foodies and event-goers.

- 1 Scene+ level per greenback spent on all different purchases.

The cardboard can be marketed as providing as much as 6 Scene+ factors per greenback spent on eligible journey purchases, and at first look, incomes 6x Scene+ factors on Scene+ Journey sounds nice — however there’s a catch.

All Scene+ members earn 3 Scene+ factors per greenback spent on resort bookings, automobile leases, and issues to do booked through Scene+ Journey.

Incomes 6x Scene+ factors simply implies that you’ll earn 3x Scene+ factors for eligible journey purchases out of your bank card, in addition to an extra 3x factors on resort bookings, automobile leases, and issues to do booked by Scene+ Journey.

Moreover, this elevated incomes fee solely applies to bookings made by the Scene+ Journey portal, which implies that you lose out on precious loyalty advantages like elite standing, factors accumulation, and/or qualifying nights that you just’d earn when you guide immediately with the resort or automobile rental chain.

This can be a main downside, particularly when you favor to maximise your resort and automobile rental loyalty program perks.

Maybe probably the most underwhelming side of this card is its baseline incomes fee of simply 1 Scene+ level per greenback spent on non-bonus classes.

Many different premium journey playing cards in Canada provide a baseline incomes fee of 1.25 factors per greenback spent, such because the TD® Aeroplan® Visa Infinite Privilege* (1.25 Aeroplan factors per greenback spent) or the RBC® Avion Visa Infinite Privilege† (1.25 Avion factors per greenback spent).

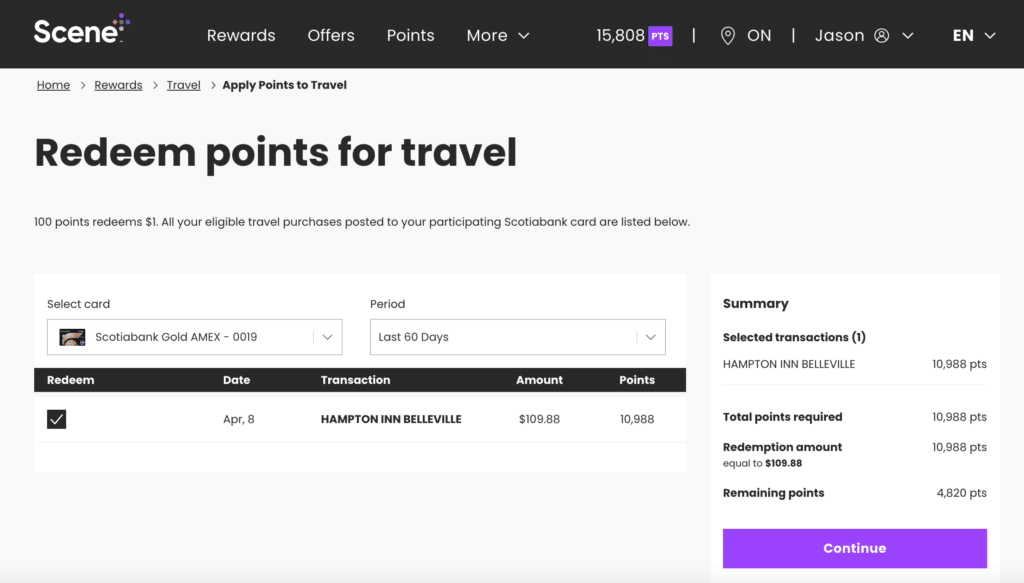

Redeeming Scene+ Factors

One of many strongest options of the Scotiabank Passport® Visa Infinite Privilege* Card is the versatile redemption choices provided with Scene+ factors.

In contrast to different fixed-value rewards packages in Canada that require you to guide journey by in-house journey companies, Scene+ factors can help you guide any journey the best way you need and apply your factors later.

- Factors are value 1 cent per level, that means 10,000 factors = $100 in journey redemptions.

- Factors could be redeemed for flights, lodges, automobile leases, trip packages, and extra.

- Redemptions could be made as an announcement credit score as much as 12 months after the transaction date.

- Scene+ factors by no means expire so long as your account stays open.

This flexibility is particularly helpful for resort bookings. Since you’ll be able to guide immediately with the resort chain, you’ll be able to get pleasure from elite standing perks, earn resort factors, and accumulate qualifying nights—one thing many different journey rewards packages don’t enable.

Perks & Advantages

One of many greatest benefits of this card is that it waives international transaction charges, making it a really perfect journey bank card and for worldwide purchases. Whereas most Canadian bank cards cost a 2.5% markup on international transactions, this card processes purchases on the Visa mid-market trade fee with no added charges.

The cardboard additionally gives complimentary airport lounge entry by the Visa Airport Companion Program, providing 10 free lounge visits per 12 months at over 1,200 airport lounges worldwide.

Different key advantages embrace:

- $250 annual journey credit score, which applies to flights, lodges, and trip packages booked by Scene+ Journey.

- Visa Infinite Privilege precedence providers, together with precedence check-in, precedence safety lanes, and expedited baggage dealing with at choose Canadian airports.

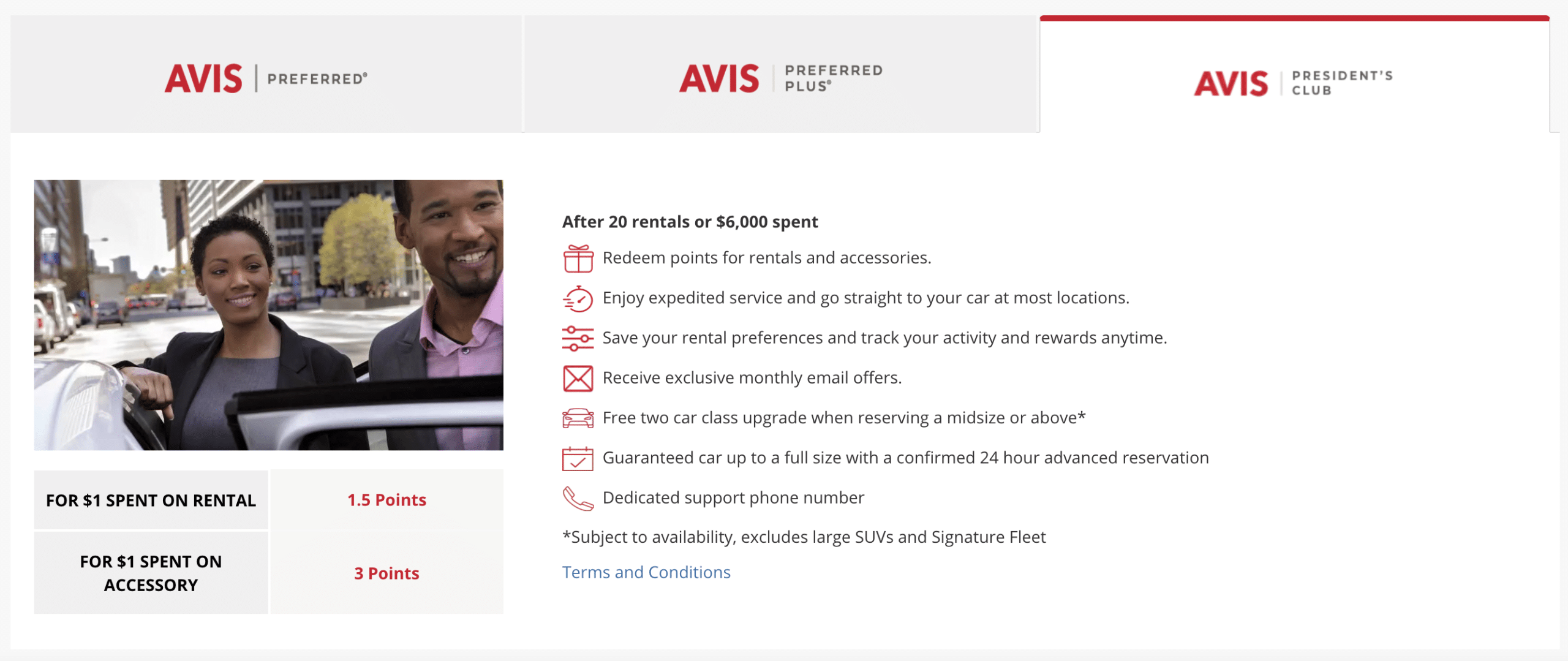

- Complimentary Avis® President’s Membership membership, offering free car-class upgrades and precedence service.

- Unique resort advantages, together with VIP perks at Relais & Châteaux properties and the Visa Infinite Luxurious Lodge Assortment.

That mentioned, the $250 journey credit score is restricted to Scene+ Journey bookings, which isn’t very best. A really premium journey card ought to provide a journey credit score that can be utilized immediately with airways or lodges, moderately than limiting it to a particular reserving portal.

A full listing of advantages and card options could be discovered on the Scotiabank web site.

Insurance coverage Protection

As a premium journey bank card, the Scotiabank Passport® Visa Infinite Privilege* Card contains complete journey insurance coverage:

- Emergency medical insurance coverage: As much as $5 million for journeys as much as 31 days (10 days for travellers aged 65+).

- Journey cancellation and interruption insurance coverage: As much as $2,500 per particular person for journey cancellation and $5,000 per particular person for journey interruption.

- Flight delay insurance coverage: As much as $1,000 per particular person for delays over 4 hours.

- Misplaced and delayed baggage insurance coverage: As much as $1,000 per particular person.

- Rental automobile collision and injury insurance coverage: Covers autos with an MSRP of as much as $85,000, eliminating the necessity for rental automobile insurance coverage.

- Cell system insurance coverage: Covers as much as $1,000 for misplaced, stolen, or broken smartphones and tablets.

- Buy safety and prolonged guarantee: Extends producer warranties by as much as two years and covers purchases in opposition to theft or injury for 180 days.

With this strong insurance coverage package deal, the cardboard presents peace of thoughts when touring or making main purchases.

Ought to You Apply for the Scotiabank Passport® Visa Infinite Privilege* Card?

The Scotiabank Passport® Visa Infinite Privilege* Card is an upgraded model of the Scotiabank Passport® Visa Infinite* Card, which has lengthy been a favorite amongst Canadian travellers for its no international transaction charges and strong incomes construction.

In comparison with the Scotiabank Passport® Visa Infinite* Card, this Visa Infinite Privilege model presents greater incomes charges on journey, extra lounge visits, and stronger insurance coverage protection. Nonetheless, regardless of being a premium card with a hefty $599 annual payment, some elements of its incomes construction fall in need of expectations.

For frequent travellers who spend closely on journey and eating, this card delivers glorious worth by robust incomes charges, premium advantages, and versatile redemptions.

The largest benefits of the cardboard embrace:

- No international transaction charges, saving 2.5% on all international purchases.

- 10 annual airport lounge visits, very best for frequent flyers.

- $250 annual journey credit score, offsetting a superb portion of the annual payment.

- Sturdy insurance coverage protection, making it an important main journey card.

Nonetheless, there are just a few drawbacks that may’t be ignored. It’s a bit shocking to see the dearth of a grocery multiplier, a low baseline incomes fee of 1 Scene+ level per greenback spent, and the journey credit score being restricted to Scene+ Journey make this card much less aggressive than it might be.

In case your spending isn’t closely focused on journey purchases, the mid-tier Scotiabank Passport® Visa Infinite Card with an annual payment of $150 may really be a more sensible choice—providing no international transaction charges, six lounge visits, and powerful multipliers on grocery, eating, leisure, and transit.

Alternatively, the Scotiabank Gold American Categorical® Card has glorious incomes charges of as much as 6 Scene+ factors per greenback spent, relying on the class.

Conclusion

The Scotiabank Passport® Visa Infinite Privilege* Card is an thrilling new addition to the premium journey bank card market in Canada. It presents glorious perks for frequent travellers, however its incomes construction may have been stronger given the excessive annual payment.

In case you worth excessive incomes fee on journey purchases, no FX charges, and lounge entry, this card is actually value contemplating.

Nonetheless, for many who prioritize greater on a regular basis incomes charges, different playing cards just like the Scotiabank Passport® Visa Infinite Card or the Scotiabank American Categorical® Gold Card might present higher total worth.